A significant crisis is unfolding within Baker Hughes, a major employer in the UK’s oilfield services sector. The company has issued formal redundancy notices to a substantial portion of its UK workforce, creating a tense and uncertain atmosphere for thousands of employees. This situation, particularly impacting workers in north-east Scotland, is directly linked to proposed changes in the company’s pension scheme and raises serious questions about job security and retirement prospects.

The Scale of the Redundancy Threat: A Look at the Numbers

The magnitude of the potential job losses is considerable. Baker Hughes has initiated advance redundancy notices affecting approximately 4,500 UK employees. The impact is particularly acute in north-east Scotland, a region heavily reliant on the energy sector. Over 1,000 of those at risk are based in key locations including Aberdeen, Montrose, Portlethen, Peterhead, and Dyce. This widespread notification highlights the potentially far-reaching consequences of the proposed changes.

Understanding the Affected Workforce

The proposed changes are not a blanket application across the entire workforce. A crucial distinction exists regarding employees’ hiring dates. Those hired after August 1, 2024, are already operating under a pension plan with lower contribution levels and, therefore, are not directly impacted by the upcoming alterations. The focus of the changes is on existing employees, many of whom have dedicated years of service to the company.

The Proposed Pension Changes: What’s at Stake?

At the heart of this crisis lies a proposed reduction in employer pension contributions. Baker Hughes is seeking to reduce these contributions by up to 25% for nearly 4,600 active members of the pension scheme. These proposed changes would bring current employees’ contribution levels in line with those offered to new hires since August 2024. The effective date for these changes is January 1, 2026.

The “Fire and Rehire” Tactic: A Controversial Approach

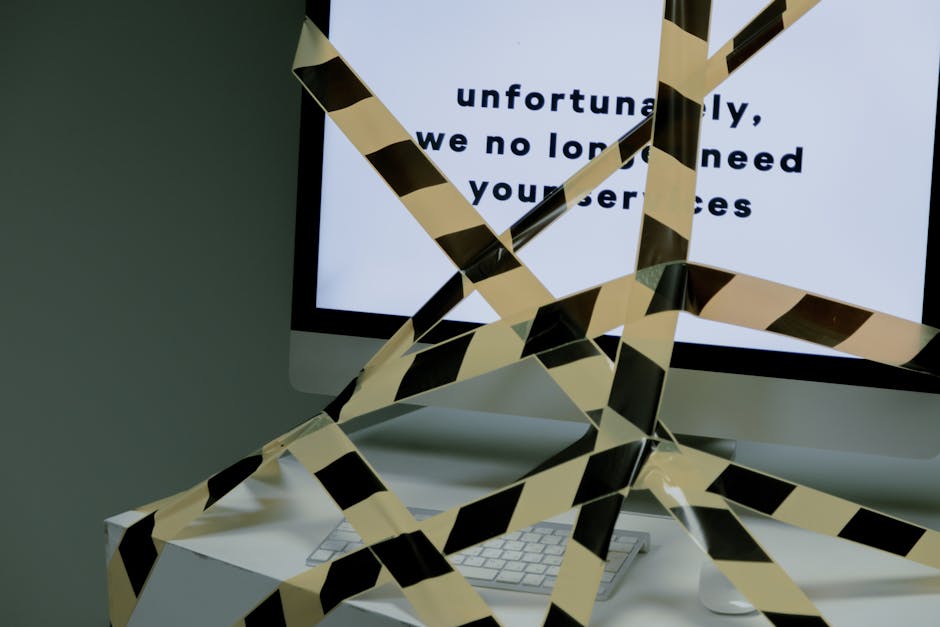

Adding further complexity and anxiety to the situation is the company’s communication outlining the potential consequences of declining the revised pension terms. Workers have been informed that refusal to accept the changes could result in dismissal, followed by an offer to re-engage under the new, less favorable conditions. This practice, commonly referred to as “fire-and-rehire,” is currently legal, but it is slated for significant restriction under upcoming UK employee rights legislation. The timing of this approach has drawn significant criticism.

Baker Hughes’ Rationale: Sustainability and Competitiveness

Baker Hughes defends its position by stating that the proposed changes are vital for ensuring sustainable business practices. The company aims to position itself within the top 25% of UK employers regarding pension contributions. Management maintains that the HR1 redundancy notice, while concerning, is a statutory requirement and forms part of a broader communication package designed to provide employees with context and understanding of the proposal.

Recent Financial Developments

It’s worth noting that Baker Hughes recently concluded a £900 million pension buy-in deal, securing benefits for over 7,000 retired and deferred members across three legacy schemes. While this demonstrates a commitment to pension security for some, it hasn’t alleviated concerns regarding the proposed changes for active employees.

Employee and Community Response: A Wave of Opposition

The announcement has been met with strong opposition from employees and union representatives. The core concern revolves around the significant reduction in retirement benefits and the perceived use of redundancy as leverage to force acceptance of the new terms. Many workers feel the timeline provided is excessive and suspect the move is strategically timed to precede the implementation of new legal restrictions on “fire-and-rehire” tactics. This perception fuels distrust and deepens the sense of injustice.

A History of Workforce Adjustments

This crisis arrives amidst a history of workforce reductions and restructuring at Baker Hughes’ UK operations. Previous rounds of redundancies and facility sales have already impacted the region, making the current situation even more precarious for remaining employees.

Broader Context and Implications: More Than Just a Local Issue

The proposed pension cuts and the associated threat of redundancy extend beyond a simple employment dispute. They raise fundamental questions about job security, retirement adequacy, and the broader treatment of oil and gas workers in the UK. The situation highlights ongoing challenges in the energy sector, where companies grapple with cost pressures, legacy benefit obligations, and evolving legal frameworks.

Economic Impact on North-East Scotland

The economic consequences for north-east Scotland are considerable. The region’s economy is heavily reliant on the energy sector, and the significant employment footprint of Baker Hughes makes the potential job losses particularly damaging. Local communities are closely monitoring developments and bracing for the potential impact on livelihoods and economic stability.

Looking Ahead: Guidance and Next Steps

Given the complexity of the situation, employees are strongly advised to take proactive steps. This includes thoroughly reviewing the proposed pension changes, seeking independent financial advice to understand the long-term implications, and actively monitoring communications from both the company and relevant trade unions. It’s critical for individuals to be fully informed and understand their rights.

Pension Plan Management and Future Changes

The transition of pension plan management to a qualified insurance carrier is also underway, and interest crediting rates are set to change following the plan’s proposed termination date in July 2025. These changes add further complexity for employees to navigate and require careful attention.

The move by Baker Hughes to reduce pension contributions and the associated redundancy threat represents a significant shift in employment and retirement conditions for thousands of UK workers. The implications extend far beyond individual employees, impacting local communities and raising crucial questions about the future of the energy sector and the treatment of its workforce.

Leave a Reply

You must be logged in to post a comment.